When you hear these results coming out from Microsoft- And we see the stock reaction that we have now. John, I want to turn this question over to you. You can see it's still down about 3 and 1/2% there on your screen.ĮMILY MCCORMICK: All right, Yahoo Finance's Jared Blikre, thank you so much. Not really seeing any negative news of note, but we will continue diving through this report. That is the first time they have topped $50 billion in any quarter in their history, so pretty impressive there. She's saying, "Solid commercial execution, represented by strong bookings growth driven by long-term Azure commitments, that increased Microsoft Cloud revenue to $22.1 billion, up 32% year over year."Īnd just to go over that headline number one more time, revenue of $51.73 billion. Now, I want to go through a quote from Amy Hood that- she's their executive vice president and chief financial officer. And they also returned $10.9 billion to shareholders via repurchases and dividends in the second quarter. Estimate was for a little bit lower, $5.83 billion. Capital expenditures- looks like a small beat there, $5.87 billion.

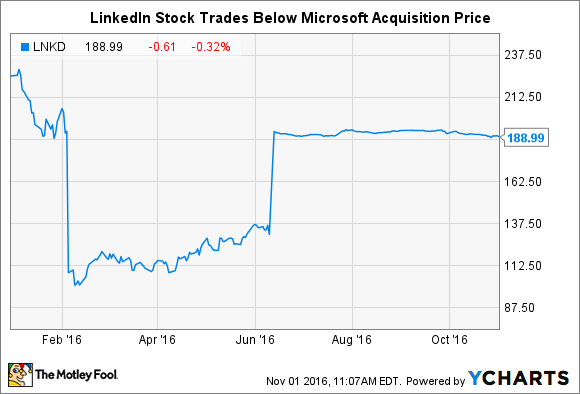

Operating income, $22 and 1/4 billion, and that is greater than the $21.06 billion the Street was expecting. 26% gain year over year, and the estimate was for- well, we're going to call this in line, $18.32 billion.Īnd then a nice beat on personal computing- $17 and 1/2 billion versus $16.67 billion. That revenue coming in at $18.33 billion. That came in at $15.94 billion- very small beat over the estimate, also up 19% year over year. Now, breaking that down by segment, we have productivity and business processes revenue. That is up 20% year over year, and it is greater than the Street estimate of about $50.87 billion. So revenue for the second quarter, their second fiscal quarter, came in at $51.73 billion. You can see it's down about 5% in after-hours trading after being 2 and 1/2% down today. Lots of beats, so have to really dig into this report. LinkedIn shares have lost nearly a quarter of their value in the last three months.JARED BLIKRE: That's right, and I'm looking at all the key headline numbers and even some of the other ones. “Given those macro concerns and LinkedIn’s recent execution issues, we expect investors will demand financial outperformance before there is meaningful recovery in LNKD’s multiple,” Goldman Sachs analysts wrote in a client note. LinkedIn has been spending heavily on expansion by buying companies, hiring sales personnel and growing outside the United States, but is now facing pressure in Europe, the Middle East, Africa and Asia-Pacific due to macro-economic issues. Facebook, Alphabet and Inc are better picks for investors than LinkedIn, Evercore analysts wrote. LinkedIn should be trading at $71.79, a 35% discount to the stock’s Friday’s low of $75.54, according to StarMine’s Intrinsic Valuation model, which takes analysts’ five-year estimates and models the growth trajectory over a longer period. “We were wrong,” they said in a client note.Īs of Thursday, LinkedIn shares were trading at 50 times forward 12-month earnings versus Twitter’s 29.5 times, Facebook’s 33.8 and Alphabet’s 20.9, making it one of the most expensive stocks in the tech sector.Įven after the selloff, LinkedIn’s shares may still be overvalued, according to Thomson Reuters StarMine data. RBC analysts said they had thought LinkedIn was on the cusp of “fundamentally positive” change. Underscoring the slowdown in growth, LinkedIn said online ad revenue growth slowed to 20% in the fourth quarter from 56% a year earlier. “This would imply that LinkedIn will grow around 15% in 2017 and 10% in 2018,” the Mizuho analysts said. LinkedIn forecast full-year revenue of $3.60-$3.65bn, missing the average analyst estimate of $3.91bn, according to Thomson Reuters I/B/E/S. At least 22 brokerages cut their price targets on the stock, with RBC slashing its target by almost half to $156. Raymond James, Cowen and Co, BMO Capital Markets, JP Morgan Securities, RBC Capital Markets and Suntrust Robinson also downgraded the stock. Mizuho downgraded the stock to “neutral” and slashed its target price to $150 from $258. “With a lower growth profile, we believe that LinkedIn should not enjoy the premium multiple it has grown accustomed to,” Mizuho Securities USA Inc analysts wrote in a note.

0 kommentar(er)

0 kommentar(er)